“The FinTech Era: A Digital Revolution in the World of Money”

Financial Technology (FinTech): A Revolution in the World of Money

Financial era, or “FinTech,” is one of the maximum distinguished traits inside the present day era, combining generation with monetary offerings to offer progressive and powerful solutions within the monetary area. The concept of monetary offerings is now not restricted to standard banks or insurance organizations; it now features a huge range of digital services aimed toward enhancing user experience and improving performance.

1. What is Financial Technology?

Financial generation refers to using era to supply monetary offerings, along with cash control, fee facilitation, and mission financing. FinTech objectives to enhance the person revel in and simplify monetary approaches that have been previously complicated. This generation includes various monetary sports, from bills and money transfers to loans, insurance, and investments.

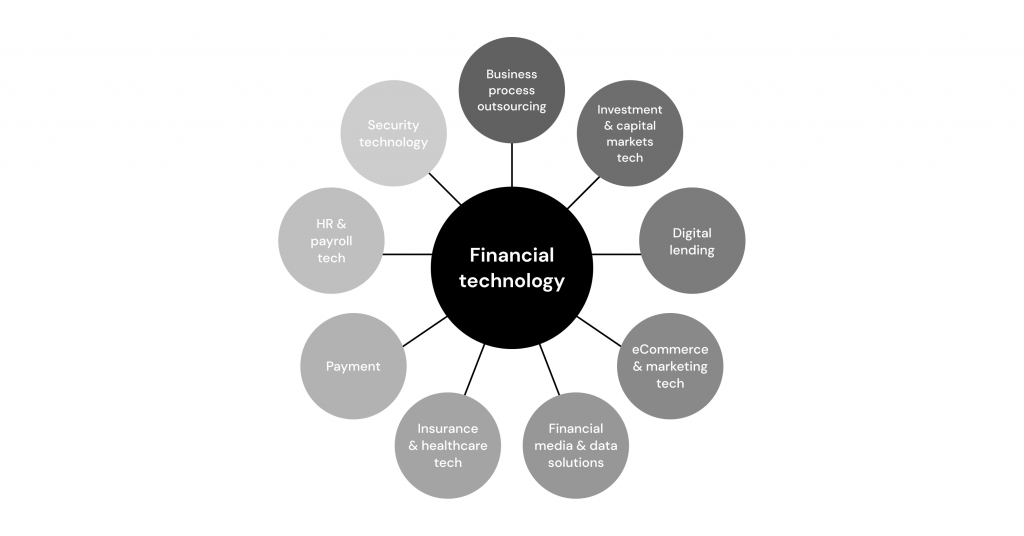

2. Types of Financial Technology

FinTech may be divided into several foremost categories, each with its specific makes use of and dreams:

A. Digital Payment Services

This class includes all solutions that enable customers to make bills on line or thru cellular packages. Mobile wallets like Apple Pay and Google Pay are most of the most super examples. These offerings offer secure and fast techniques for making bills, reducing reliance on cash.

B. Digital Banking

Digital banks are financial establishments that offer their services totally online with out the want for traditional branches. These banks allow customers to open financial institution bills, make transfers, and control loans, all easily via cellular programs. Notable examples encompass N26 and Revolut.

C. Trading and Investment

Investment platforms like Robinhood and eToro enable people to trade in stocks and virtual property in a easy and direct way. These structures offer instructional gear and resources to help new traders recognize economic markets and make knowledgeable decisions. Some systems additionally offer crowdfunding options, permitting people to take part in new tasks with decrease monetary sources.

D. Personal Finance

Personal finance packages inclusive of Mint and YNAB (You Need A Budget) assist people manipulate their budgets and track their spending. These programs provide complete insights into spending behaviors and help customers in achieving their financial dreams.

E. Digital Insurance

Insurance era, or “InsurTech,” objectives to improve purchaser enjoy within the insurance zone. Digital coverage companies make use of technologies inclusive of large information and synthetic intelligence to evaluate dangers and decide costs extra as it should be, making it simpler for clients to acquire suitable insurance.

F. Crowdfunding

Crowdfunding is a model that gathers cash from a huge organization of humans to help a selected venture. Platforms like Kickstarter and Indiegogo permit innovators and project owners to elevate funds from involved investors, facilitating the release of their tasks.

3. Benefits of Financial Technology

FinTech brings numerous benefits, including:

Increased Efficiency: Digital strategies reduce the time and expenses associated with traditional monetary offerings.

Accessibility: FinTech enhances get admission to to monetary offerings, especially for people in far off areas or those without bank money owed.

Improved Customer Experience: It gives consumer-pleasant interfaces and tailored alternatives that better meet patron needs.

Innovation: FinTech drives innovation in the financial zone, contributing to the improvement of new and superior services.

4. Challenges and Limitations

Despite the numerous blessings, economic generation additionally faces some of challenges, which includes:

Security and Data Protection: The improved use of digital services increases the risks of cyberattacks and facts theft. Companies need to spend money on information security to ensure the protection of users’ monetary statistics.

Regulatory Issues: FinTech businesses face regulatory demanding situations due to the dearth of appropriate criminal frameworks in some nations. Governments need to set up laws that regulate this zone in a manner that protects consumers.

Financial Literacy: Many people nonetheless lack the necessary information to apply financial era efficiently, necessitating efforts for training and consciousness.

5. The Future of Financial Technology

The FinTech zone is expected to maintain developing and evolving, with the emergence of recent technologies which include synthetic intelligence and blockchain. These innovations will make contributions to changing the manner we manage money and could open new horizons for enhancing financial services. Additionally, developments like digital currencies and sustainable economic era could result in radical modifications inside the economic zone.

Conclusion:

Financial technology represents a real revolution within the world of cash, contributing to extended performance and facilitating get admission to to economic offerings. Despite the demanding situations it faces, ongoing innovations on this field promise a brilliant destiny, making sure better and safer monetary services for all individuals. Investing in FinTech isn’t simply an choice; it’s miles a necessity that keeps tempo with the fast changes within the international economic system.